The New York State Tuition Assistance Program (TAP) helps eligible New York residents pay tuition at approved schools in New York State. Depending on the academic year in which you begin study, an annual TAP award can be up to $5,165. Because TAP is a grant, it does not have to be paid back.

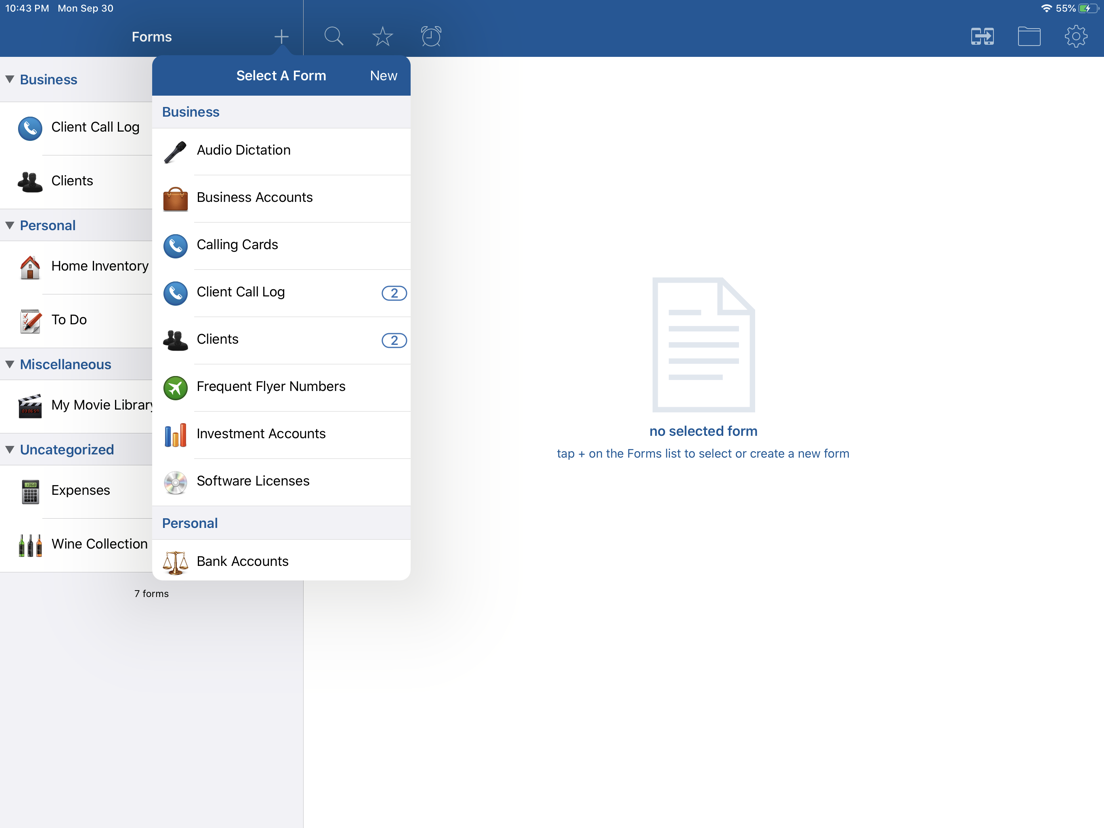

Apply through the FAFSA. The easiest way to apply for TAP is through the FAFSA.Make sure you have completed your FAFSA! New York State (NYS) residents attending NYS schools can link directly to the TAP application from the FAFSA submission confirmation page. PDF Forms & Instructions. PAST YEAR INFORMATION. Info from previous years. This website is provided for general guidance only. It does not contain all tax laws or rules. For security reasons, TAP and other e-services are not available in most countries outside the United States. 'Tap Forms is a great choice for a database for a small business. I am a small business owner, and for years I used a FileMaker Pro database that I designed. But that application has become far more advanced than I need and way too expensive. Tap Forms has been a great replacement, and is ready to use once installed on your computer.

TAP is also available for students attending a SUNY, CUNY and not-for-profit independent degree-granting college on a part-time basis. To be eligible for Part-time TAP you must have been a first-time freshman in the 2006-07 academic year or thereafter, have earned 12 credits or more in each of two consecutive semesters, and maintain a 'C' average.

- NYS TAP

- NYS DREAM Act TAP Applicants

Eligibility:

Magic map ct. An applicant must:

- be a legal resident of NYS and have resided in NYS for 12 continuous months;

- be a U.S. citizen or eligible noncitizen;

- have graduated from high school in the United States, earned a high school equivalency diploma by passing a Test Assessing Secondary Completion (TASC) formally known as a GED, or passed a federally approved 'Ability to Benefit' test as defined by the Commissioner of the State Education Department;

- study at an approved postsecondary institution in New York State;

- be matriculated in an approved program of study and be in good academic standing with at least a 'C' average as of the 4th semester payment

- be enrolled as a full-time student taking twelve or more credits applicable toward the degree program, per semester;

- be charged at least $200 tuition per year;

- meet income eligibility limitations;

- not be in default on any state or federal student loans and not be in default on any repayment of State awards;

- be in compliance with the terms of any service condition imposed by a NYS award.

* Credit-bearing courses in the student's minimum full-time course load (12 semester hours or the equivalent) must consist of courses applicable to the student's program of study as a general education requirement, major requirement, or elective.

Click here if you do not meet the above eligibility requirements.

TAP Income Limits

| Student Type | NYS Taxable Income Limit |

|---|---|

| Dependent undergraduate students or Independent students who are married and have tax dependents, or Independent students who are unmarried and have tax dependents, or students who qualified as an orphan, foster child or ward of the court at any time since the age of 13 | $80,000 |

| Independent undergraduate students who are married and have no other tax dependents | $40,000 |

| Single independent undergraduate students with no tax dependents | $10,000 |

Apply through the FAFSA

The easiest way to apply for TAP is through the FAFSA. Make sure you have completed your FAFSA!

New York State (NYS) residents attending NYS schools can link directly to the TAP application from the FAFSA submission confirmation page.

Tap Forms

Didn't Apply for TAP through the FAFSA? You Can Still Apply

If you exited the FAFSA before completing the TAP application – and you filled in your New York State address and a New York State college on the FAFSA – HESC will automatically receive your information in about three days. HESC will then send you an email or postcard with directions to complete the TAP application online.

Received this notice from HESC? Apply now.

The Application Process Begins with Creation of Your HescPIN

At the beginning of the online TAP application, you will be prompted to create a HESC-specific user name and personal identification number called a HescPIN. You will use your HescPIN when 'signing' your TAP application and when accessing your HESC account information in the future.

Need Help or More Information?

Contact HESC.

Eligibility

You may be eligible if:

- Your permanent home is in NYS and you are or have ONE of the following:

- Temporary protected status, pursuant to the Federal Immigration Act of 1990

- Without lawful immigration status (including those with DACA status)

- AND you meet ONE of the following criteria:

- You attended a NYS high school for 2 or more years, graduated from a NYS high school, and enroll or enrolled for undergraduate study at a NYS college within 5 years of receiving your NYS high school diploma OR

- You received a NYS high school equivalency diploma, and enroll or enrolled for undergraduate study at a NYS college within 5 years of receiving your NYS high school equivalency diploma OR

- You are or will be charged the NYS resident in-state tuition rate at a SUNY or CUNY college for a reason other than residency.

- Your permanent home is outside of NYS and you are or have ONE of the following:

- U.S. citizen

- Permanent lawful resident

- Of a class of refugees paroled by the attorney general under his or her parole authority pertaining to the admission of aliens to the U.S.

- Temporary protected status, pursuant to the Federal Immigration Act of 1990

- Without lawful immigration status (including those with DACA status)

- AND you meet ONE of the following criteria:

- You attended a NYS high school for 2 or more years, graduated from a NYS high school, and enroll or enrolled for undergraduate study at a NYS college within five years of receiving your NYS high school diploma OR

- You received a NYS high school equivalency diploma,and enroll or enrolled for undergraduate study at a NYS college within five years of receiving your NYS high school equivalency diploma OR

- You are or will be charged the NYS resident in-state tuition rate at a SUNY or CUNY college for a reason other than residency.

- You study at an approved postsecondary institution in New York State;

- You are matriculated in an approved program of study and are in good academic standing with at least a 'C' average as of the 4th semester payment

- You are enrolled as a full-time student taking twelve or more credits* applicable each term toward your degree program;

- You are charged at least $200 tuition per year;

- You meet the income eligibility limits;

- You are not in default on any state or federal student loans or in default on any repayment of State awards;

- You are in compliance with the terms of any service condition imposed by a NYS award.

- * Credit-bearing courses in the student's minimum full-time course load (12 semester hours or the education requirement, major requirement, or elective).

Note: A student seeking New York State financial aid, including TAP, for the first time, must pass a federally approved ATB test identified by the Board of Regents if the student does not possess a U.S. high school diploma or its recognized equivalent.

TAP Income Limits

| Student Type | NYS Taxable Income Limit |

|---|---|

| Dependent undergraduate students or independent students who are married and have tax dependents, or independent students who are unmarried and have tax dependents, or students who qualified as an orphan, foster youth or ward of the court at any time since the age of 13 | $80,000 |

| Independent undergraduate students who are married and have no other tax dependents | $40,000 |

| Single independent undergraduate students with no tax dependents | $10,000 |

How To Apply

Students newly applying for NYS financial aid under the provisions of the DREAM Act must first apply for eligibility under the NYS DREAM Act before applying for TAP. If you have previously qualified under the NYS DREAM Act, you will simply need to add a new application to apply for TAP.

Monitoring the Status of Your Application

Once you have submitted an application, it is your responsibility to monitor the status of your application and to make sure your application is complete. You will be able to monitor the status of your application online after submitting your application and uploading any required documentation.

這款《DearMob iPhone Manager》原價 US$65.95 (約 HK$515),提供一鍵備份及還原 iOS 裝置數據功能,支援iPhone、iPad 及 iPod。 編輯精選推薦 已累計獲得不同國家超過200家知名科技網站的編輯好評。. Highlights of DearMob iPhone Manager: Allows you to delete unwanted photos and video in iPhone camera selectively or in batch. Enables two-way file transfer between iPhone and computer selectively. Fully back up or restore iPhone file. Manage music/playlist, photo/albums, contacts: export, add, create, modify, delete, rebuild, edit, etc. DearMob iPhone Manager is made for seamless iOS/iPadOS data backup, restore and transfer giving you a variety of access to import, export, edit, organize, migrate and manage all your iDevice files.

Award Notification and Acceptance

You will be notified by email when a determination has been made regarding your eligibility for each award for which you have applied. If you are determined to be eligible for an award, your next step will be to accept the award!

For certain awards, you must sign a contract agreeing to live and/or work in New York State for a required number of years after graduation as a condition of receiving the award. If you decide not to accept an award with a post-graduation requirement, please indicate this on the contract.

Frequently Asked Questions

Term Definitions

- Temporary Protected Status (TPS): allows foreign nationals to remain in the U.S. if during the time they were in the U.S. something catastrophic happened in their country of origin preventing their safe return – for example war, famine, natural disaster, or epidemic. TPS allows people to work legally and be protected from deportation.

- T-Visa: allows the granting of lawful status to noncitizen victims of human trafficking, as well as their immediate family members, who assist in the prosecution of the trafficking. It allows people to remain and work temporarily in the U.S.

- U-Visa: allows for the granting of lawful status to noncitizen crime victims who suffered significant physical or mental abuse (and their immediate family members) who assist in the prosecution of the crime. It allows people to remain and work temporarily in the U.S.

- Without Lawful Immigration Status: living in the U.S. unlawfully either because lawful status never existed (including those with DACA status) or has ended.

Harvard encourages lifelong learning by helping to cover the cost of undergraduate or graduate courses. The Tuition Assistance Program (TAP) assists with classes taken at Harvard. The Tuition Reimbursement Program (TRP) assists with classes taken at other accredited schools.

This benefit is a great way to enhance your career or pursue a personal academic interest. TAP and TRP are available to benefits-eligible professional, administrative, support, union and teaching staff. For additional details, including waiting periods for new employees and eligibility based on hours worked, please consult the TAP/TRP Booklet. For additional details, including waiting periods for new employees and eligibility based on hours worked, please consult the Benefits Enrollment Guide for administrative/professional or bargaining unit/union staff, as appropriate.

TAP

With TAP, classes are only $40 at the Harvard Extension School or 10 percent of the tuition cost at other eligible Harvard schools. This includes the graduate schools of education, government, public health and design, as well as designated programs at some other faculties.

Employees may pursue an undergraduate or graduate degree, as well as several graduate certificates at the Harvard Extension School. The Extension School offers hundreds of evening classes and flexible degree programs.

A graduate degree or certificate may also be earned through certain TAP-eligible programs at the Graduate School of Education, Harvard Kennedy School and the T.H. Chan School of Public Health.

Before enrolling, it's important to review the TAP/TRP Booklet, which has details on waiting periods for new employees; eligibility based on employee group and hours worked; credit limits; participating faculties at Harvard; and how to register. (Please note that you may view a table of contents in the booklet by selecting the bookmark icon in the top margin.)

For TAP forms go to Tuition Program (TAP/TRP) Self Service.

Revised TAP Administration Process for Graduate Courses

Tap Forms App

Per IRS standards, certain TAP benefits must be treated as taxable income. Specifically, TAP benefits for courses that meet all three criteria below will be treated as taxable income:

- Taken for graduate credit (courses taken for undergraduate credit or for no credit are not taxable);

- Not related to your current job duties (per the IRS standard); and

- The total tuition benefits for such courses during a calendar year exceeds $5,250.

In such cases, amounts above $5,250 will be reported as income to the employee on the W-2 and the University will withhold taxes on this amount from employee's pay (employees may choose to pay the full amount of taxes to Harvard Payroll in lieu of withholding).

Employees may designate a course as job-related when enrolling using a graduate-credit TAP form, where they can describe the job-related skills that will be learned; the completed form must be signed by the supervisor/manager.

Harvard recognizes that tuition assistance is an important benefit to the University community and will provide financial assistance to employees who owe tax on TAP benefits through the spring term of 2021 through a Transitional TAP Fund (TTF).

Tap Forms

Didn't Apply for TAP through the FAFSA? You Can Still Apply

If you exited the FAFSA before completing the TAP application – and you filled in your New York State address and a New York State college on the FAFSA – HESC will automatically receive your information in about three days. HESC will then send you an email or postcard with directions to complete the TAP application online.

Received this notice from HESC? Apply now.

The Application Process Begins with Creation of Your HescPIN

At the beginning of the online TAP application, you will be prompted to create a HESC-specific user name and personal identification number called a HescPIN. You will use your HescPIN when 'signing' your TAP application and when accessing your HESC account information in the future.

Need Help or More Information?

Contact HESC.

Eligibility

You may be eligible if:

- Your permanent home is in NYS and you are or have ONE of the following:

- Temporary protected status, pursuant to the Federal Immigration Act of 1990

- Without lawful immigration status (including those with DACA status)

- AND you meet ONE of the following criteria:

- You attended a NYS high school for 2 or more years, graduated from a NYS high school, and enroll or enrolled for undergraduate study at a NYS college within 5 years of receiving your NYS high school diploma OR

- You received a NYS high school equivalency diploma, and enroll or enrolled for undergraduate study at a NYS college within 5 years of receiving your NYS high school equivalency diploma OR

- You are or will be charged the NYS resident in-state tuition rate at a SUNY or CUNY college for a reason other than residency.

- Your permanent home is outside of NYS and you are or have ONE of the following:

- U.S. citizen

- Permanent lawful resident

- Of a class of refugees paroled by the attorney general under his or her parole authority pertaining to the admission of aliens to the U.S.

- Temporary protected status, pursuant to the Federal Immigration Act of 1990

- Without lawful immigration status (including those with DACA status)

- AND you meet ONE of the following criteria:

- You attended a NYS high school for 2 or more years, graduated from a NYS high school, and enroll or enrolled for undergraduate study at a NYS college within five years of receiving your NYS high school diploma OR

- You received a NYS high school equivalency diploma,and enroll or enrolled for undergraduate study at a NYS college within five years of receiving your NYS high school equivalency diploma OR

- You are or will be charged the NYS resident in-state tuition rate at a SUNY or CUNY college for a reason other than residency.

- You study at an approved postsecondary institution in New York State;

- You are matriculated in an approved program of study and are in good academic standing with at least a 'C' average as of the 4th semester payment

- You are enrolled as a full-time student taking twelve or more credits* applicable each term toward your degree program;

- You are charged at least $200 tuition per year;

- You meet the income eligibility limits;

- You are not in default on any state or federal student loans or in default on any repayment of State awards;

- You are in compliance with the terms of any service condition imposed by a NYS award.

- * Credit-bearing courses in the student's minimum full-time course load (12 semester hours or the education requirement, major requirement, or elective).

Note: A student seeking New York State financial aid, including TAP, for the first time, must pass a federally approved ATB test identified by the Board of Regents if the student does not possess a U.S. high school diploma or its recognized equivalent.

TAP Income Limits

| Student Type | NYS Taxable Income Limit |

|---|---|

| Dependent undergraduate students or independent students who are married and have tax dependents, or independent students who are unmarried and have tax dependents, or students who qualified as an orphan, foster youth or ward of the court at any time since the age of 13 | $80,000 |

| Independent undergraduate students who are married and have no other tax dependents | $40,000 |

| Single independent undergraduate students with no tax dependents | $10,000 |

How To Apply

Students newly applying for NYS financial aid under the provisions of the DREAM Act must first apply for eligibility under the NYS DREAM Act before applying for TAP. If you have previously qualified under the NYS DREAM Act, you will simply need to add a new application to apply for TAP.

Monitoring the Status of Your Application

Once you have submitted an application, it is your responsibility to monitor the status of your application and to make sure your application is complete. You will be able to monitor the status of your application online after submitting your application and uploading any required documentation.

這款《DearMob iPhone Manager》原價 US$65.95 (約 HK$515),提供一鍵備份及還原 iOS 裝置數據功能,支援iPhone、iPad 及 iPod。 編輯精選推薦 已累計獲得不同國家超過200家知名科技網站的編輯好評。. Highlights of DearMob iPhone Manager: Allows you to delete unwanted photos and video in iPhone camera selectively or in batch. Enables two-way file transfer between iPhone and computer selectively. Fully back up or restore iPhone file. Manage music/playlist, photo/albums, contacts: export, add, create, modify, delete, rebuild, edit, etc. DearMob iPhone Manager is made for seamless iOS/iPadOS data backup, restore and transfer giving you a variety of access to import, export, edit, organize, migrate and manage all your iDevice files. DearMob iPhone Manager - An easy iOS manager to transfer your iPhone data with encryption method. Backup & restore iPhone iPad offline, selectively transfer & manage any iOS file. Make your iOS devices simply mastered on computer, deliver the power, simplicity and security that iPhone users need.

Award Notification and Acceptance

You will be notified by email when a determination has been made regarding your eligibility for each award for which you have applied. If you are determined to be eligible for an award, your next step will be to accept the award!

For certain awards, you must sign a contract agreeing to live and/or work in New York State for a required number of years after graduation as a condition of receiving the award. If you decide not to accept an award with a post-graduation requirement, please indicate this on the contract.

Frequently Asked Questions

Term Definitions

- Temporary Protected Status (TPS): allows foreign nationals to remain in the U.S. if during the time they were in the U.S. something catastrophic happened in their country of origin preventing their safe return – for example war, famine, natural disaster, or epidemic. TPS allows people to work legally and be protected from deportation.

- T-Visa: allows the granting of lawful status to noncitizen victims of human trafficking, as well as their immediate family members, who assist in the prosecution of the trafficking. It allows people to remain and work temporarily in the U.S.

- U-Visa: allows for the granting of lawful status to noncitizen crime victims who suffered significant physical or mental abuse (and their immediate family members) who assist in the prosecution of the crime. It allows people to remain and work temporarily in the U.S.

- Without Lawful Immigration Status: living in the U.S. unlawfully either because lawful status never existed (including those with DACA status) or has ended.

Harvard encourages lifelong learning by helping to cover the cost of undergraduate or graduate courses. The Tuition Assistance Program (TAP) assists with classes taken at Harvard. The Tuition Reimbursement Program (TRP) assists with classes taken at other accredited schools.

This benefit is a great way to enhance your career or pursue a personal academic interest. TAP and TRP are available to benefits-eligible professional, administrative, support, union and teaching staff. For additional details, including waiting periods for new employees and eligibility based on hours worked, please consult the TAP/TRP Booklet. For additional details, including waiting periods for new employees and eligibility based on hours worked, please consult the Benefits Enrollment Guide for administrative/professional or bargaining unit/union staff, as appropriate.

TAP

With TAP, classes are only $40 at the Harvard Extension School or 10 percent of the tuition cost at other eligible Harvard schools. This includes the graduate schools of education, government, public health and design, as well as designated programs at some other faculties.

Employees may pursue an undergraduate or graduate degree, as well as several graduate certificates at the Harvard Extension School. The Extension School offers hundreds of evening classes and flexible degree programs.

A graduate degree or certificate may also be earned through certain TAP-eligible programs at the Graduate School of Education, Harvard Kennedy School and the T.H. Chan School of Public Health.

Before enrolling, it's important to review the TAP/TRP Booklet, which has details on waiting periods for new employees; eligibility based on employee group and hours worked; credit limits; participating faculties at Harvard; and how to register. (Please note that you may view a table of contents in the booklet by selecting the bookmark icon in the top margin.)

For TAP forms go to Tuition Program (TAP/TRP) Self Service.

Revised TAP Administration Process for Graduate Courses

Tap Forms App

Per IRS standards, certain TAP benefits must be treated as taxable income. Specifically, TAP benefits for courses that meet all three criteria below will be treated as taxable income:

- Taken for graduate credit (courses taken for undergraduate credit or for no credit are not taxable);

- Not related to your current job duties (per the IRS standard); and

- The total tuition benefits for such courses during a calendar year exceeds $5,250.

In such cases, amounts above $5,250 will be reported as income to the employee on the W-2 and the University will withhold taxes on this amount from employee's pay (employees may choose to pay the full amount of taxes to Harvard Payroll in lieu of withholding).

Employees may designate a course as job-related when enrolling using a graduate-credit TAP form, where they can describe the job-related skills that will be learned; the completed form must be signed by the supervisor/manager.

Harvard recognizes that tuition assistance is an important benefit to the University community and will provide financial assistance to employees who owe tax on TAP benefits through the spring term of 2021 through a Transitional TAP Fund (TTF).

You can learn more, including details about the Transitional TAP Fund (TTF), definition of job-related, and how to calculate the TAP benefit and withheld tax amounts, in the Questions and Answers Regarding TAP Process Change. Please refer to the TAP/TRP booklet for the full rules and eligibility.

TRP

Tap Forms Mac Review

TRP reimburses employees up to 75 percent of tuition costs (up to 90 percent for HUCTW employees) upon the successful completion of classes at other accredited institutions. There is an annual maximum of $5,250.

Classes must be job-related, unless they are taken as part of a program to earn a first undergraduate degree at an accredited institution. For full details on eligibility, waiting periods and registration, please review the TAP/TRP Booklet prior to enrolling in a class.

Benefit Strategies, LLC (BSL) administers Harvard's TRP. For TRP forms and to apply for reimbursement go to theTuition Program (TAP/TRP) Self Servicewebsite.

Additional Assistance

Tap Forms Vs Ninox

HUCTW staff have access to a separate Education Fund, which can be used to cover seminars and conferences, test preparation course, licensing and accreditation classes and many additional educational and career development needs. For details and application, please see HUCTW website's Education Fund page or call the HUCTW at 617-661-8289.